|

|

|

|

|

|

|

|

|

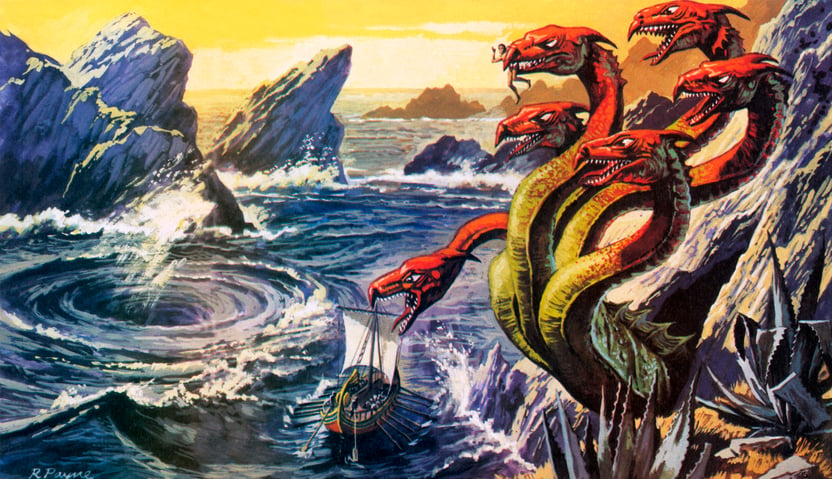

Partial Interest Gifts – Navigating Rocky Shoals and Avoiding Whirlpools

Contributions of appreciated assets offer tax savvy opportunities for gift planning. But what if the donor is not eager to part with the entire asset? That’s no problem if the asset is securities; our donor simply transfers as many shares as she chooses and keeps the rest for herself. However, other assets aren’t so easily divided – things like real estate or bank, investment, or retirement accounts. A contribution of a partial interest can allow donors to give a portion of the property and retain the rest for themselves, their family, or others.

Navigating a contribution of a partial interest can be a bit like the challenges Odysseus faced on his journey home. It wasn’t all smooth sailing. He had to navigate rocky shoals, whirlpools, and angry gods, but eventually, he made it home safely.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|